Retirement Planning

While everyone would like to retire comfortably, the complexity and time required to build a successful retirement plan can make the whole process daunting.

However, it can often be done with fewer headaches (and financial pain) than you might think - all that's required is a little homework, an attainable savings and investment plan, and the right advisers.

In short, retirement planning is the process of identifying your wants and needs, developing plans to achieve them, acting on those plans and reviewing and revising them as you gain new knowledge and experience.

- Retirement annuities

- Provident & pension funds

- Post & pre-retirement plans

- Preservation plans

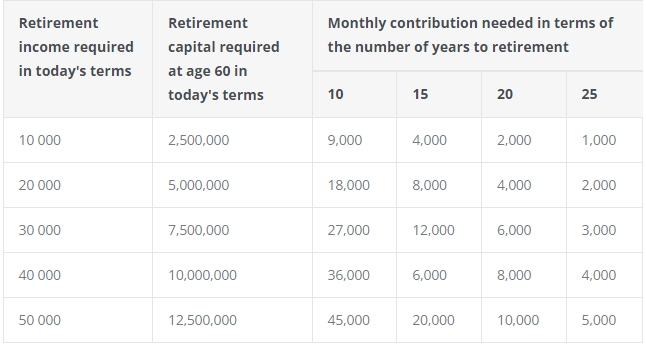

Have a look at this table, which shows the huge difference 5 years can make when it comes to starting retirement planning now! Calculate what your contribution needs to be pm in order to retire at the same standard of living.